By Mark Clark, ABOC, MBA

Feb. 2, 2022

The demands and limitations that managed care places on ODs can be challenging to overcome to build a profitable practice. Here are a few changes you can make to boost profitability despite the pressures placed on you by managed care.

Altogether, taking these actions could double your practice’s profitability.

Implement a More Profitable Frame-Buying Strategy

The common insurance model of contracted laboratories makes frame profit a key area where a practice can make changes that impact profit margins and overall insurance revenue.

When I first began as a frame buyer in the early 2000’s, I quickly realized that I had two whole frame boards with zero net profit on the most common insurance plan in the area. I watched as opticians repeatedly took patients to these two boards and told them “these frames are fully covered.” Not only was this a terrible sales tactic, it was also destroying our margins.

As the buyer, I knew I had paid $27 dollars for these frames, and the wholesale plan allowance at the time was $29. I walked back to our insurance biller’s office to see a remittance and understand how much we were paid on these frames by the plan. She explained that we were getting reimbursed only $29. I was shocked. I immediately exchanged all of these frames for ones with better margins and had an office meeting on how to change the frame sale dialogue.

I encourage you to create a frame-buying strategy with your buyer to protect these margins by only stocking products which yield a profit. If the buyer understands the margins, then the the rest of the staff is relieved of the burden of trying to squeeze a profit from each sale.

While “covered” frame options may not be the most profitable, they are still required by most plans. It is important that covered frame options are purchased at a significant discount off of the frame list price. This is the purpose of “value” frames. These are frames that often have a high list price and an extremely low acquisition cost. Some offices may feel that closeouts are best for covered options, however these frames may not have a list price suitable for the insurance plan reimbursement, and also can have warranty issues later.

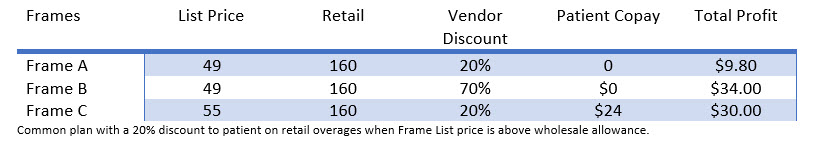

In the following example, consider a common insurance plan with a $50 wholesale allowance and a $130 retail allowance with several different frames:

In this example, because Frame A has a list price under the plan allowance, the patient has no additional co-pay, and the frame profit (not including shipping and staff time) is only $9.80. Frame B is a “value” frame purchased at a significant discount off of list price. Value frames are often sold by vendors with a standard discount of 50-80 percent off of list price. This discount results in a significantly higher margin for the practice.

I recommend creating a board of “covered” frames to satisfy the requirements of the insurance company. Once the buyer understands these margins, the staff does not have to be trained on the nuances of profit. They simply know that if a patient demands a covered option that these frames will have the necessary profit for the practice.

The next takeaway is from the difference between Frame A and Frame C. You need to eliminate frames which have little, or no, profit to the practice. Frames which are just below the plan allowance like Frame A, but are not purchased at a deep discount, have little, or no, value to the practice and should be eliminated. Even though there is only a $6 difference between the list price of these two frames, the profit is significantly different.

Other Articles to Explore

To make this process simple, have your insurance biller give you a few remittances from common plans in your area, then use the method above to understand which price points should be eliminated from your boards entirely. Once your frame buyer understands this concept, they can ensure that all frames on the boards have an acceptable margin. This will immediately yield higher margins with minimal staff training overall.

Select the Most Profitable Lens Options

The contract laboratory model also limits the ability of a practice to increase margins on lenses. Just as you may want to remove frames from your boards that have little, or no, profit, you also want to remove lens styles and options that offer a low profit.

Many offices have a price sheet from their laboratory where they have added their retail price to the hundreds of lens choices available to the office from that laboratory. This may be a tactic which works well for patients without insurance, but it may not serve the office well on insurance plans.

When there are too many options, both opticians and patients can get lost. With hundreds of options available, the office can easily identify a simple offering that is also profitable for the practice.

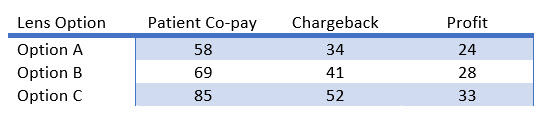

Accomplishing this will require some of the same steps taken to remove the least profitable frames from your optical. I recommend pulling common remittances and plan authorization sheets with reimbursement schedules for the plans that you see most often in your area. Then use this process to identify the lens options yielding the highest profit.

In this example, Option C yields more profit than Option A. This is typically the case with most plans, but occasionally a plan will have a better profit on option A than on option B. This could be due to the sheer volume and purchasing agreement that the insurance company has with the laboratory. Because of this, it is best to look at the plans in your area, then create a price sheet that reflects profitable options for your opticians to sell. Some offices also add small bonuses for selling lens options that are profitable for the practice.

Often, when an office does not understand the frame and lens profit model, they may charge the patient incorrectly. This may result in the office receiving a letter instructing them to reimburse the patient. Jason Kaplan, CPSL, a certified professional sales leader and wholesale optical representative at Modern Optical International, says that when an office receives a letter like this, “it is embarrassing to the practice” and “potentially harmful to their reputation in the community.” This is another reason why it is best to simplify the lens options that are offered in your office.

Offer Patient Financing Options

Nearly every optician has encountered the patient who tells them, “I only want what is covered.” But the truth is, no one really wants what is only covered by their insurance. Most of the time what they are trying to say is they want a nice pair of glasses, but the expense is not currently in their budget. A great way to handle these situations is by offering patient financing options like CareCredit or Sunbit.

CareCredit works like a credit card service for health-related expenses. Sunbit is a kind of “point-of-service loan” that allows the consumer to spread payments over a period while the office gets paid within a day or two for the transaction in full.

The ability to finance out-of-pocket expenses may enable some patients to get the eyewear that they really want, without exceeding their budget for that month. According to a recent Consumer Report, the average out-of-pocket expense for eyewear was $234, with most plans capped at $120 reimbursement.

Offices that use some type of financing have discovered noticeable increases in sales and capture rate:

“CareCredit helps me attract more patients and has raised my average sale price significantly, increasing my revenue and profitability.” —Robert Chu, DO, Eyeworks Group, Fort Worth, Texas.

“In under three months we increased our revenue by $95,000 and amazingly doubled our capture rate! Sunbit has helped increase our multiple-pair sales by 66.5 percent” —Athena Brasfield, OD, owner, Coachella Valley Optometry, Coachella, Calif.

Opticians and sales associates need to be trained on how to educate patients about the financing option, and how to help them through the approval process. Both Sunbit and CareCredit supply the office with guides to walk the optical employee and patient through the approval process.

Conclusion: Adding and Subtracting to Find the Most Profitable Mix of Products & Offering Patient Financing

Increased profit can be achieved by adding profitable frame and lens options and subtracting frame and lens options that yield little-to-no profit.

This can be accomplished by making sure that one key person, such as the office manager or frame buyer, has the training necessary to guard profit margins in the products that are purchased for the optical.

Next, add financing options to empower the patient to purchase what they really want. Then, make sure opticians understand how to offer this financing and obtain approval.

You will be surprised at the huge difference to patient satisfaction and profitability the actions recommended in this article can have on a practice.

Mark Clark ABOC, MBA, is a former practice owner with 20 years in the optical industry. He has an MBA in Healthcare Administration and is Vice-President of Digital Services at Modern Optical International.

Mark Clark ABOC, MBA, is a former practice owner with 20 years in the optical industry. He has an MBA in Healthcare Administration and is Vice-President of Digital Services at Modern Optical International.